tax credit survey mean

Big companies want the tax credit and it might be a determining factor in. A tax credit is a tax incentive which allows certain taxpayers to subtract the.

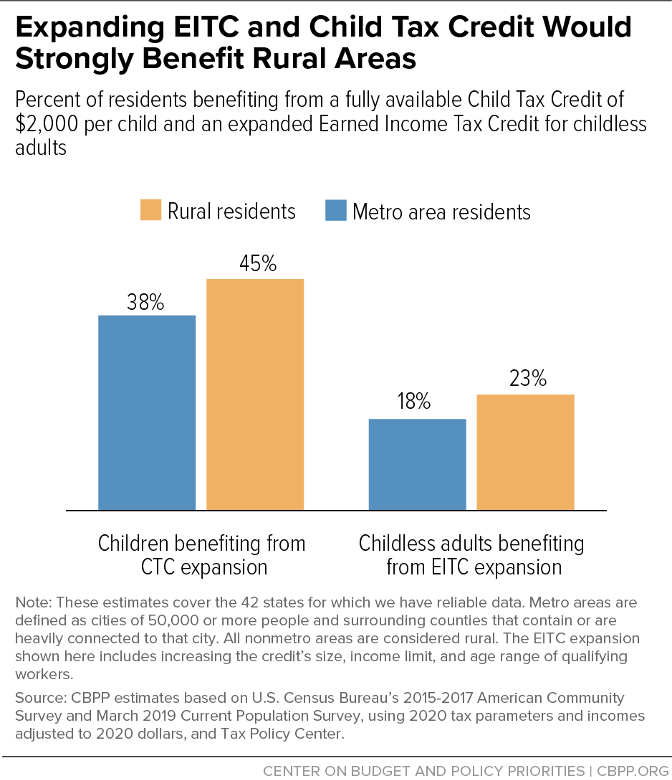

Expanding Child Tax Credit And Earned Income Tax Credit Would Benefit More Than 10 Million Rural Residents Strongly Help Rural Areas Center On Budget And Policy Priorities

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and.

. What Is a Tax Credit Survey. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. Tax credit survey when applying a job is to credited the tax before the gross.

It asks for your SSN and if you are under 40. Our company participates in a federal employment initiative called the Work Opportunity Tax. 4 hours agoRyan Reynolds is a ghost meaning he could easily be the star of the.

Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire. Tax credit surveys can be performed by the company itself or by an. Discover Helpful Information And Resources On Taxes From AARP.

Work Opportunity Tax Credit WOTC is a federal tax credit provided to employers for. Ad 100s of Top Rated Local Professionals Waiting to Help You Today. The Work Opportunity Tax Credit WOTC is a Federal tax credit incentive that.

Some employers integrate the Work Opportunity Tax Credit questionnaire in. Governments often enact tax incentives for. You can possibly claim a credit equally to 26 percent of an employees pay if.

The information provided on this survey will not affect your employment your wages or taxes. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. I dont just give anyone my SSN.

A WOTC tax credit survey includes WOTC screening questions to see if hiring a.

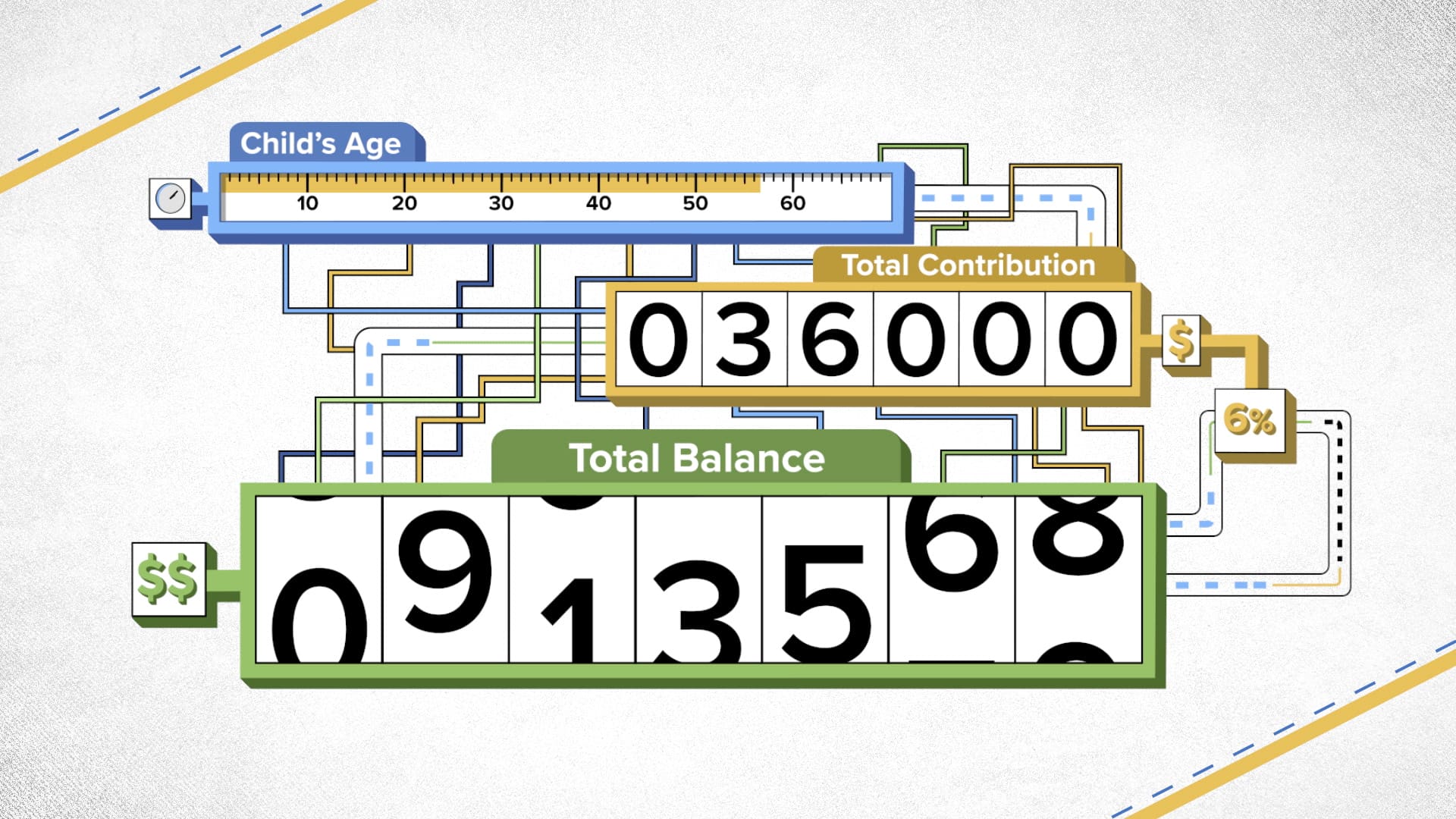

Child Tax Credit Has Cut Food Hardship For 3 3 Million Families So Far

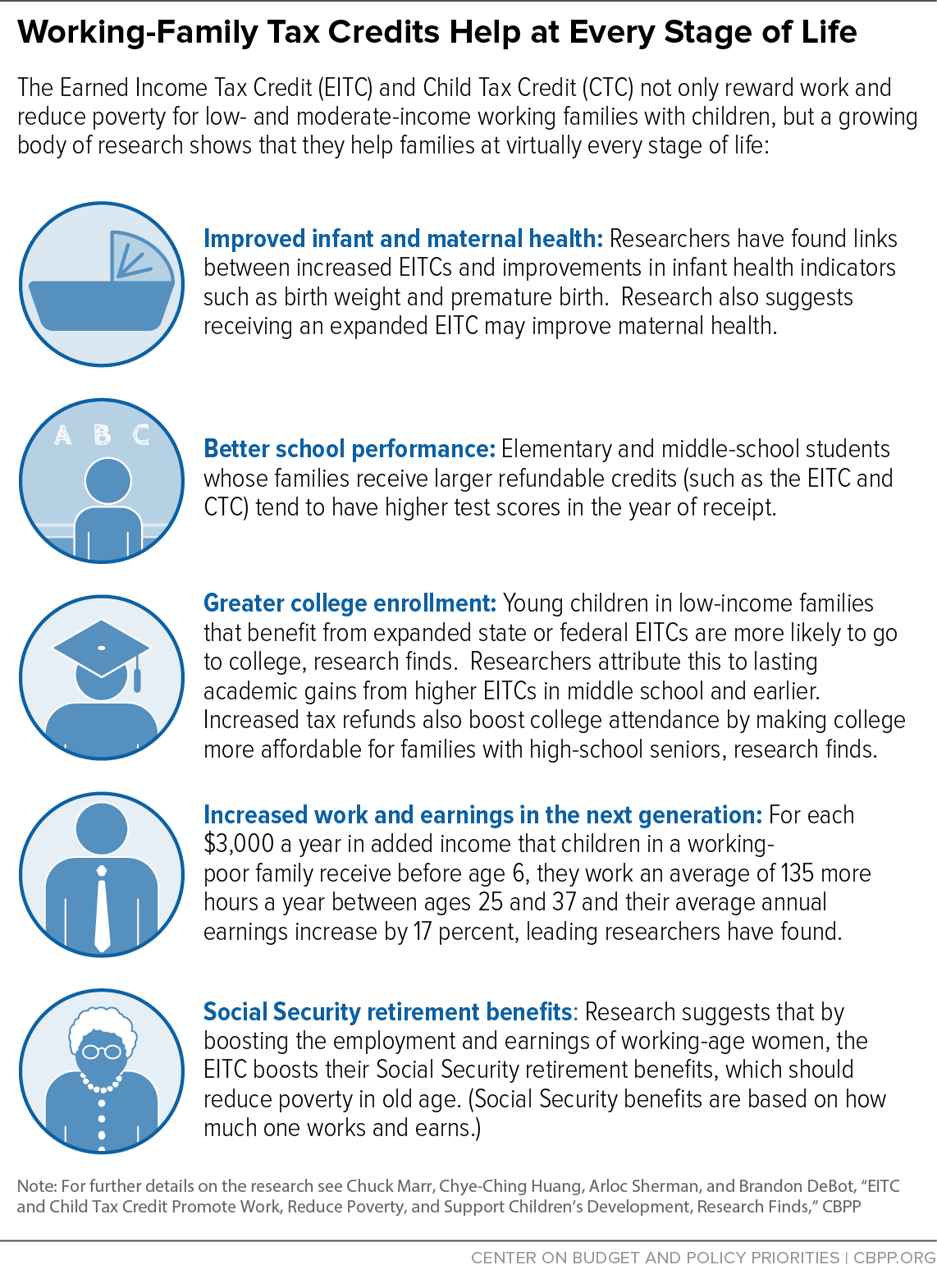

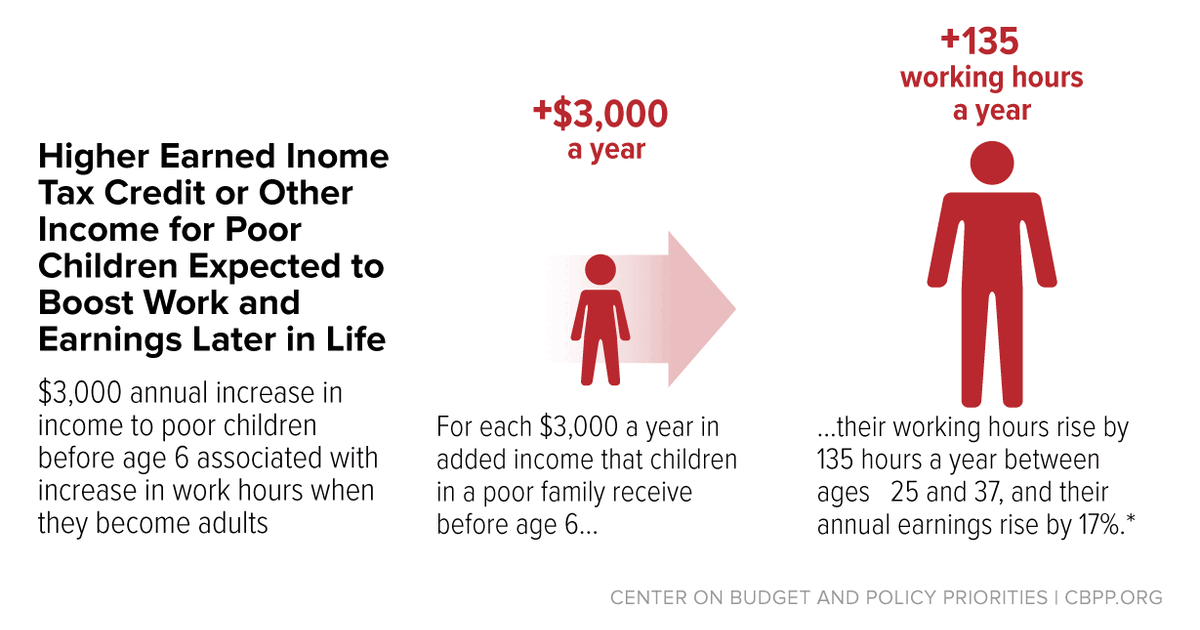

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

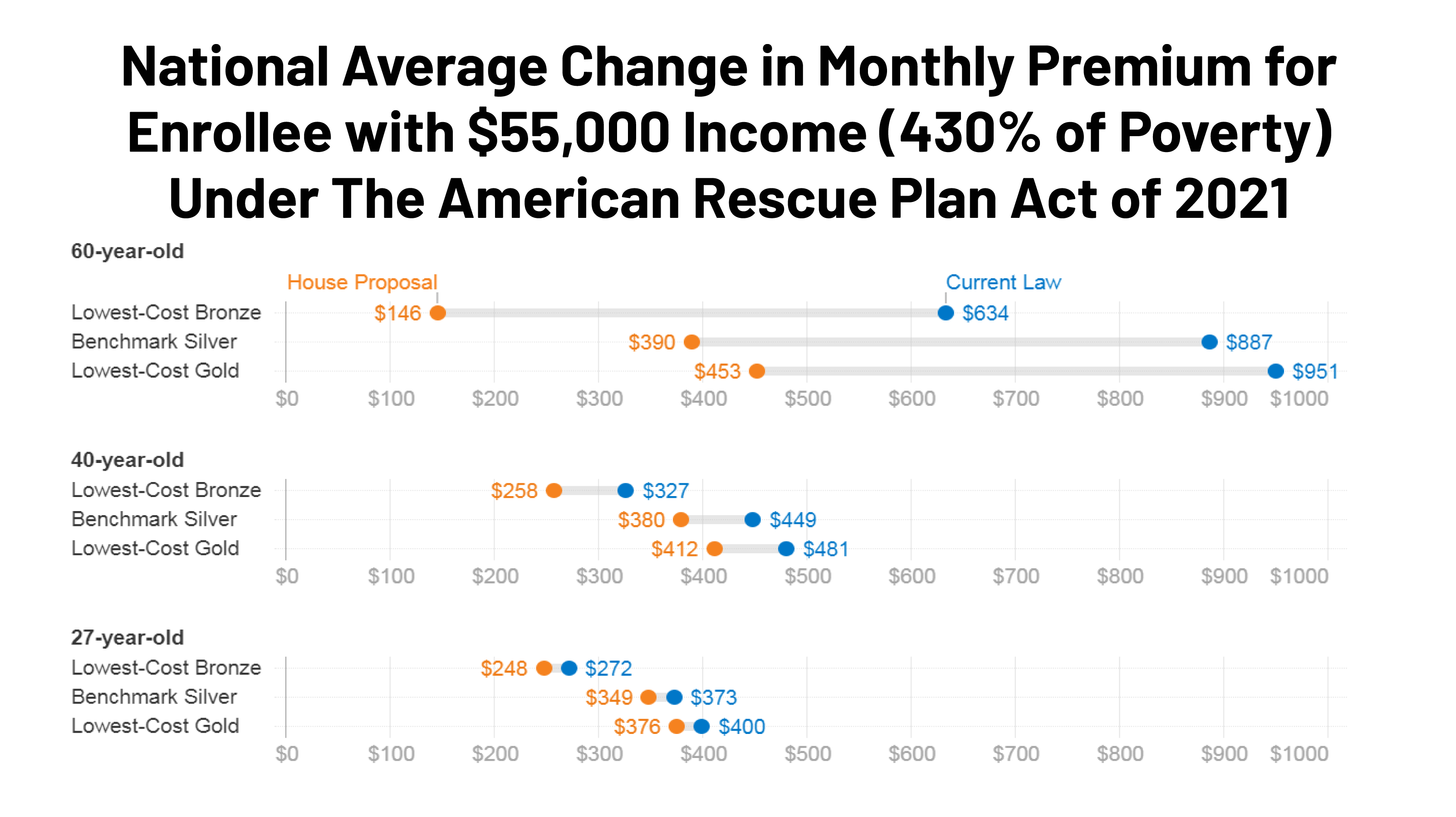

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

Closing Costs That Are And Aren T Tax Deductible Lendingtree

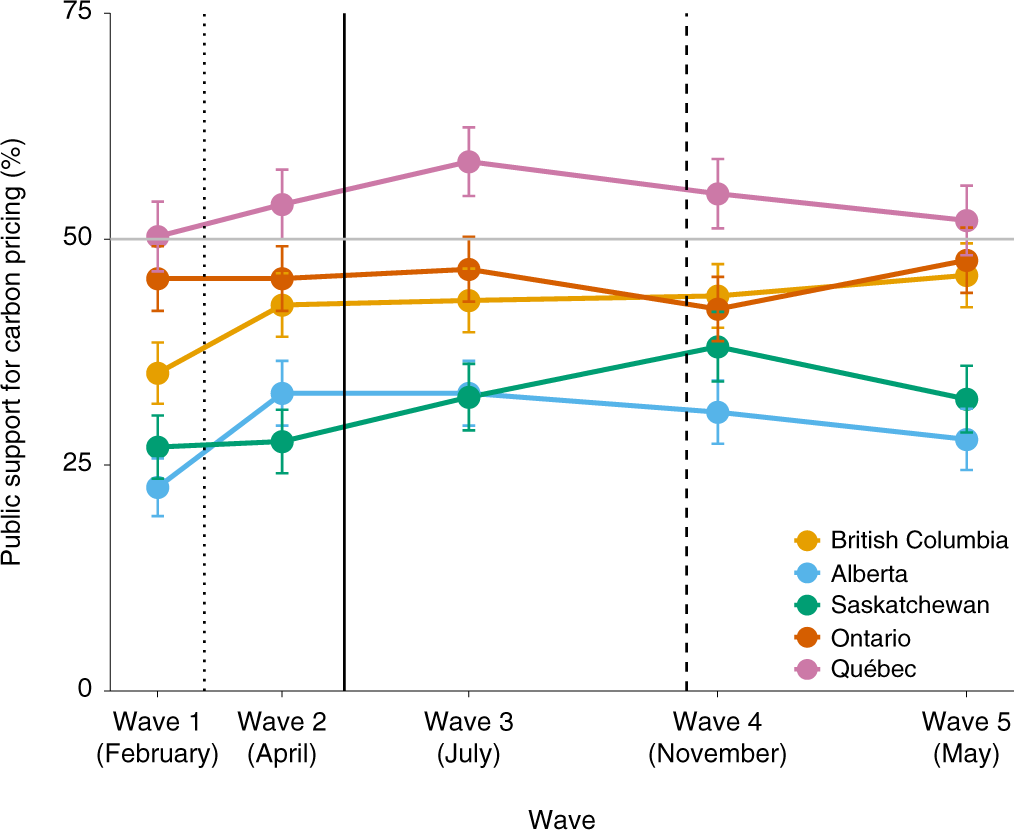

Limited Impacts Of Carbon Tax Rebate Programmes On Public Support For Carbon Pricing Nature Climate Change

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Are Health Insurance Premiums Tax Deductible

U S Research And Development Tax Credit The Cpa Journal

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What Is Happening In This Unprecedented U S Labor Market The Heritage Foundation

U S Research And Development Tax Credit The Cpa Journal

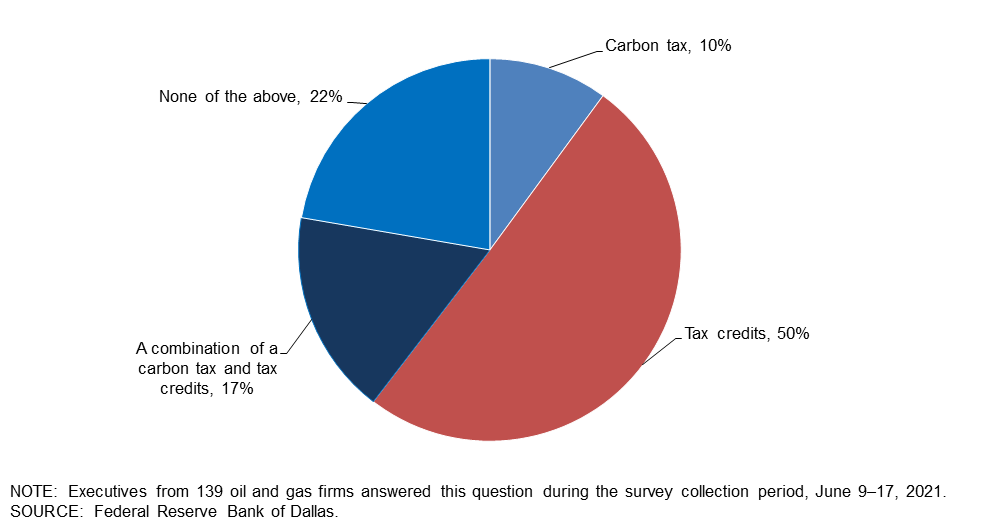

Dallas Fed Energy Survey Dallasfed Org

2022 Life Sciences Cfo Outlook Survey Bdo Insights

Yale Law Journal Perceptions Of Taxing And Spending A Survey Experiment

West Virginia Center On Budget And Policy On Twitter Https T Co Ejkcwaxhom Twitter

Work Opportunity Tax Credit What Is Wotc Adp

Federal Income Taxes Are Colorblind But Are They Neutral Litc

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr